Last month we noted a case of comparison gone wrong within Australia’s largest superfund, Australian super. An advocate of active investing had lined up the performance of Australian Super’s actively managed balanced fund and compared it to Australian Super’s lower cost indexed diversified fund to make the case that active management is the true gold standard.

Something ignored, possibly to achieve the exact conclusion reached, was the difference in asset allocation between the two funds. The active and better performing fund had a very aggressive portfolio mix with almost 85% growth assets. The index diversified fund had just under 70%.

No shock that a more aggressive portfolio mix would outperform a less aggressive peer, regardless of active or passive. That aside, it was during the research that we noticed how far the balanced fund in Australian super had lurched into growth assets.

Ask the average person and they’d probably assume a balanced portfolio was split half and half between growth and defensive assets. In the financial world, there’s a little more flexibility in the definition. Using 60-70% growth assets and 40-30% defensive assets as the definition. However, 85% in growth was a level we’d never seen before.

And it wasn’t uncommon. When super returns were released for the 2017/18 financial year last month Hostplus was sitting at the top of the pack. When their Chief Investment Officer was interviewed by The Australian, he spoke of the Hostplus asset allocation:

It has a zero allocation to cash and a 2 per cent allocation to fixed interest that it would also soon move to zero, Mr Sicilia said.

This would mean Hostplus is running with 100% growth assets. No other way of stating it – 100% growth assets is not a balanced fund. We’ll credit adviser, Marshall Brentnall, who got back on this issue quicker than we did for a good definition on this:

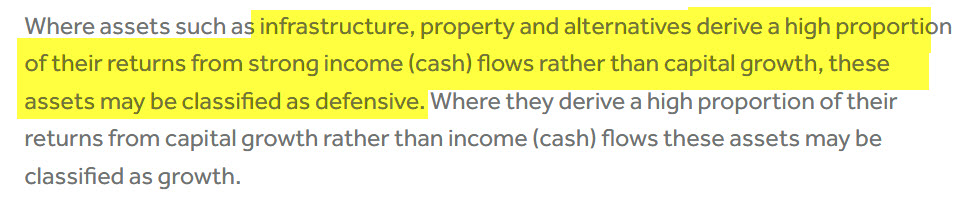

The traditional view, and in my view the correct one, is that defensive assets should be limited to cash and fixed income, such as bonds and debt. There should be no reference to property, infrastructure or private equity as these are assets that will grow in value over time.

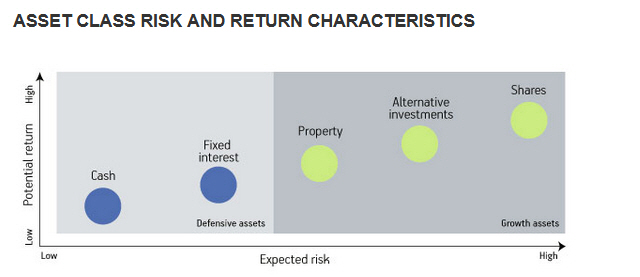

Go over to UniSuper, and by the diagram below it shows they’re defining asset classes along these traditional lines. Cash and fixed interest are defensive, while property shares and alternatives are growth. Alternatives are infrastructure and private equity, both generally being unlisted.

Yet at Hostplus things seem a little more flexible.

Possibly defining why they’re aiming to have zero cash and fixed interest in their ‘balanced’ fund. They’re squeezing out the genuinely defensive assets, to replace them with their own definition of defensive. Doing this allows them to reap the rewards of being the top performing ‘balanced’ fund. Being the top performer comes with inbuilt media coverage throughout the next year.

Wall to wall media attention and plaudits aren’t a bad thing when you’re trying to attract more members to your fund. And it’s not like journalists are going to spell this stuff out. They’re more interested in a straight returns table without taking account of the asset allocation underneath.

As Mr Brentnall further noted, if property, infrastructure and private equity were classified as growth assets across the board, only 3 of this year’s top 10 performing superfunds could be considered balanced using a criterion of 60-76% growth assets.

The returns are great, but there are implications here. There has been talk of setting up a top performers list at initial superfund signup. People would choose from a list of funds an independent panel determine to be the best options available. There’s also the bigger issue members are also taking on substantially more risk without understanding they’re doing it.

But they’re in the balanced fund, right? What could be safer than that?

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs.