Economic Overview

Q1 2024 was another positive quarter from both an economic and investment perspective. Global markets notched strong gains led by the enthusiasm for all things artificial intelligence, while the important US economy continued to prove resilient. The expectations for rate cuts have also continued to play a role in underpinning market performance, but there is some recognition the number of cuts may be fewer and the pace of them may be slower than was previously hoped. Australian shares lagged their global counterparts, but still delivered a very healthy mid single digit return, and the ever-volatile Australian listed property market had a fire under it once again. While the final quarter of 2023 was an everything rally, there was some divergence in shares and fixed interest in Q1 as the odds for rate cuts widened. This pushed global bonds back into negative territory for the quarter.

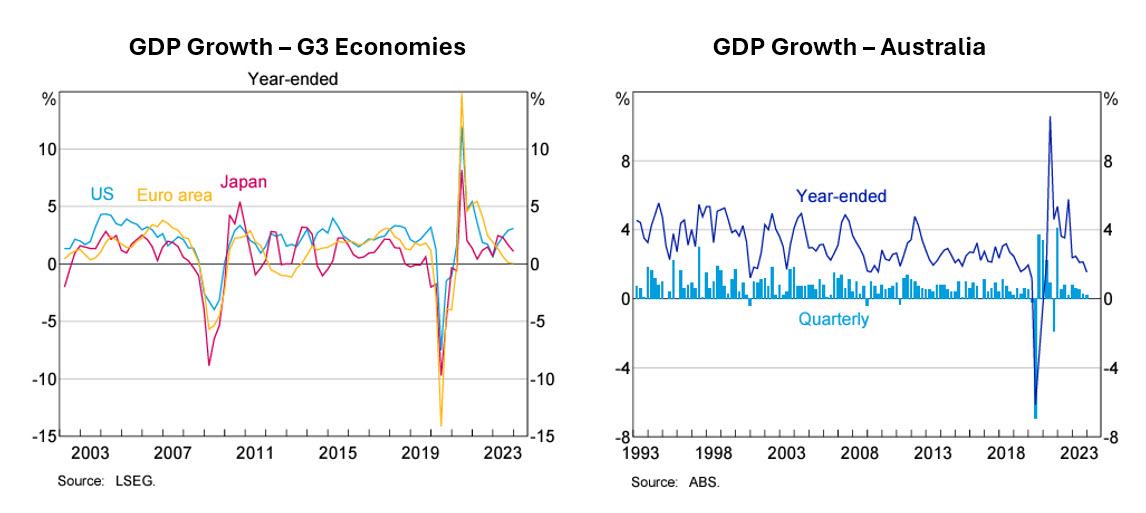

In the US, GDP came in at an annualised rate of 3.4% in Q4 2023, this was down on the previous quarter’s 4.9%, but still very healthy and above earlier estimates of real-time tracking. Much of the growth during the quarter came from the American consumer via goods and services which accounted for 2.2% of that 3.4%. Other contributors were increases in spending from local and state governments, along with fixed investment in structures, but there was a slowdown in federal government spending during the quarter.

The Purchasing Managers’ Index hit a 21-month high of 52.5 in March, signifying the health of the US manufacturing sector, with strong increases in output and employment. While supplier delivery times continue to speed up, there was a hurdle with Baltimore’s Francis Scott Key Bridge being destroyed by a cargo ship late in the quarter. How this could potentially disrupt critical East Coast supply lines isn’t yet fully known.

In March the Federal Reserve held interest rates at 5.25-5.5% for the fifth straight meeting. US annual CPI moved up slightly from 3.1% in January to 3.2% in February, but since the 3.0% reading back in June 23 the ongoing numbers have flattened out. This was after an ongoing fall over the prior 12 months. Casual (or amateur) observations would suggest the 3% figure has become something of a floor, and it might yet be too early for the Fed to declare victory on inflation, especially with a 2% target. Fed chair Jerome Powell said that the central bank will be careful on the decision to cut rates and is willing to tolerate higher near-term inflation. A key takeaway from the Fed March meeting and press conference: While inflation data seems to be heading in the wrong direction at the beginning of 2024, the Fed believes the uptick may be seasonal and the prevailing trend will be lower.

Total nonfarm payrolls rose by 275,000 in February, this was above the average monthly figure of 230,000 over the prior 12 months. While the US consumer has been resilient, there has also been a surge in household debt leaving some wondering about the potential impact on future spending. According to the Federal Reserve of NY, total household liabilities climbed by $212 billion, hitting $17.5 trillion in Q4 of 2023. Clearly there is one silver lining, strong markets mean assets have also appreciated. At the end of 2023, consumer assets are estimated at $176.7 trillion. A combination of a strong employment market and stable asset valuations will likely continue to underpin consumer spending. Real-time GDPNow tracking projects a 2.3% growth for the first quarter.

In the Eurozone, there were signs of improving economic activity during the quarter. The eurozone purchasing managers’ index rose to 49.9 in March. While a reading under 50 is still a contraction, an almost neutral reading is an improvement on 49.2 in February, and much improved on 47, which was the final reading of 2023. Inflation also continued to ease in the quarter. The annual inflation rate was 2.6% in February, down from 2.8% in January. Despite this, European Central Bank President Christine Lagarde downplayed the chances of any imminent cut to interest rates, telling the European Parliament the ECB doesn’t want to run the risk of going early and having to reverse any cuts. GDP for the final quarter of 2023 was mostly positive in the Eurozone’s largest economies, France 0.1%, the Netherlands 0.4%, Spain 0.6% and Italy 0.2%, all saw growth, while Germany -0.3%, went backwards. The German economy is struggling, with 37% of German manufacturers reporting a lack of new orders against a figure of 21% in the prior 12 months.

In the UK, official data showed that the economy had entered a technical recession in the second half of 2023. This was attributed to the final surge of post-pandemic spending coming to an end, along with higher inflation and interest rates weighing on activity. The Spring Budget saw little reaction from the market, suggesting investors may have anticipated something more to liven the economy. Towards the end of Q1, the Bank of England’s Monetary Policy Committee decided to keep the UK’s interest rate on hold at 5.25%. Annual inflation, as measured by CPI, has fallen from a peak of 11.1% in October 2022 to 3.4% in February, which is the lowest reading since September 2021.

In Japan, data showed the economy grew at 0.1% in the final quarter of 2023, meaning it narrowly avoided recession after the -0.7% contraction in Q3. The 0.1% figure came in lower than expectations of 0.3%, and was mostly driven by an upward revision in capital expenditure. Notably, private consumption which accounts for 60% of Japanese GDP, has contracted for three straight quarters. The Bank of Japan set a short-term rate at 0.0-0.1%, signalling a shift to a positive policy rate. This demonstrated the BOJ Governor Ueda’s strong confidence in Japan’s macroeconomic development, but despite this being seen as a positive, the policy move did little to support the yen, which fell to its lowest level against the US dollar since 1990.

In China, GDP growth for Q4 came in at 1.0%, on par with expectations, but down on the upwardly revised figure of 1.5% in Q3. This brought in the Q4 year on year figure at 5.2%, making it the sixth consecutive period of quarterly growth. US-China tensions popped up again, as US lawmakers attempted to discourage investments in China, but the stats say they don’t need to do much discouraging, as foreign investment in China fell to a 30 year low in 2023. This was attributed to spying detentions, US sanctions and China’s anti-espionage law, which makes doing research on business and investment decisions much harder. Despite ongoing debt issues in various parts of the Chinese economy, Beijing is planning to issue $139 billion of ultralong special treasury bonds, as a crisis management tool and source of funding to remove the burden from heavily indebted local governments.

In Emerging Markets, India continued to see increases from overseas investment as companies seek to diversify supply chains outside of China. The country’s physical and digital infrastructure has also improved, providing certainty for investment. Indian GDP came in at 8.4% year on year. Rates were lowered in some economies such as Peru and Columbia, but doubts over the timing of US rate cuts saw concerns creep into rate sensitive countries like Brazil. An election in January saw Taiwan’s ruling Democratic Progressive Party remain in power, but lose its parliamentary majority. South African GDP increased 0.1% in Q4 2023, rebounding from a contraction in Q3, with mining up and manufacturing also seeing an uptick thanks to fewer power cuts.

Back in Australia, data released in March showed GDP increasing by 0.2% for Q4 2023, down on the Q3 upwardly revised figure of 0.3%, with the economy growing by 1.5% year on year. GDP per capita, noted as a proxy for living standards, fell over the quarter again, down -0.3% and was down -1.0% year on year. Inflation trended lower, with quarterly CPI coming in at 0.6% for Q4. For the 12 months to December CPI was up 4.1%, below market expectations of 4.3%. Falls were in seen household equipment and services, along with transport and education. Aside from alcohol and tobacco, insurance and housing were notably up.

The RBA held the cash rate at 4.35% after its two meetings in Q1. The RBA noted in its March meeting that “while recent data indicate that inflation is easing, it remains high” and further “the Board expects that it will be some time yet before inflation is sustainably in the target range”. The household savings rate saw a bounce in Q4 2023 to 3.2%. This is the first quarterly change in the trajectory of the household savings rate in over two years. The savings rate has been falling since the last wave of Covid stimulus hit bank accounts.

House prices continued to increase almost everywhere during Q1 24, and across the prior 12 months. The combined capitals were up 1.5% and combined regionals were up 1.8% for the quarter. Sydney was up 0.9% for the quarter and 9.6% annually, according to CoreLogic. Every capital registered a gain in Q1 except Melbourne, down -0.2%. The strongest markets for the quarter, were again Perth at 5.6%, and Adelaide and Brisbane at 3.3% and 3.0% respectively. Hobart and Darwin saw the smallest gains across the 12 months, up 0.5% and 0.3% respectively. Due to high demand rents continued to see increases, with annual rental growth of 9.6% across the combined capitals for the past 12 months. The ongoing housing crisis can only be seen as a government inflicted one, as the government runs a record immigration program while monthly dwelling approvals continue to fall. February data showed monthly building approvals (around 12,500) have not been this low since April 2012. The government’s idea that Australia will be building 1.2 million new dwellings over the next five years seems like fantasy.

Market Overview

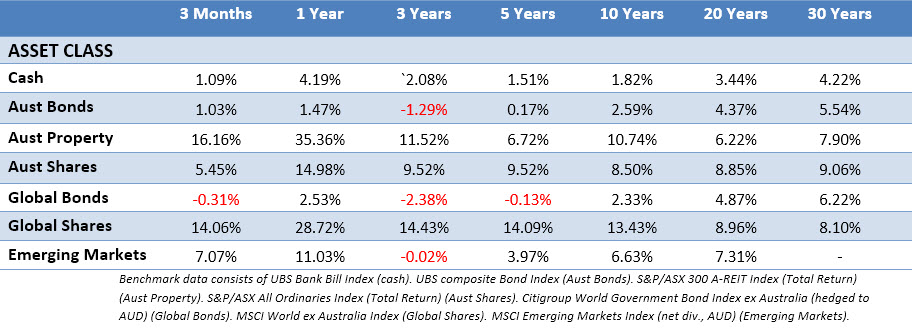

Asset Class Returns

The following outlines the returns across the various asset classes to 31 March 2024.

Global sharemarkets were very strong again in Q1, boosted by the hype around AI and demand for AI related hardware. The Australian market was up 5.45% for the quarter, while Australian listed property delivered another double-digit return. Bond prices were mostly down in Q1 as yields increased, with the market sensing rate cuts later rather than sooner. The 10-Year US Treasury yield steadily trended upward in Q1, finishing at 4.20%. US 2-year yields also increased during Q1, up from 4.25%, to finish at 4.63%. In the UK, the 10-year yield lifted from 3.53% to 3.94%, though easing back in the last two weeks of Q1. Australian 10-year and 2-Year government bonds were basically flat throughout the quarter, keeping Australian fixed interest in positive territory.

In the US, the S&P 500 was up 10.5% for the quarter and the index notched 25 new highs in the first quarter. This was the best Q1 gain for the S&P 500 since 2019. NVIDIA was the largest contributor to S&P 500 performance, with a return of 83%. To note, NVIDIA designs and manufactures graphics processing units which are highly sought after in AI. In contrast to NVIDIA’s gain, Apple, and Tesla, two of the other heavily weighted companies in the index, saw price declines of 11.3% and 30%. The small-cap Russell 2000, was up 5.2% for the quarter and 19.7% over the prior 12 months.

The first quarter saw a wider range of companies participating in the rally. The energy sector, last year’s worst performer, notched a strong 13.7% increase. Technology, financials, industrials, and materials were all strong, following low double-digit returns in 2023. Communication services was the top-performing sector in Q1, up 15.8% and continued to build on last year’s powerful performance, up 15.8% for the quarter, while real estate was the laggard down -1.1%. S&P 500 earnings are expected to grow 10.7% in 2024.

In the Eurozone, markets posted strong gains in Q1 with the MSCI EMU index up 10.25%. In France the CAC 40 was up 8.77%, while the German DAX was up 10.39%. The information technology sector again led the charge via the continual optimism and demand for AI-related technologies. Other strong performers were financials, consumer discretionary and industrials. As the economic outlook improved in the eurozone, it boosted the outlook for more economically sensitive companies. The quarter’s laggards were utilities, consumer staples and real estate.

In the UK, shares again lagged their developed market peers and it was only the large caps that delivered any notable return. The FTSE 100 was flat for most of the quarter (finishing up 2.83%) until March, when it was helped by the Governor of Bank of England stating that interest rate cuts were “on the way” later in the year. Financials, industrials, and the energy sector were the strongest performers, along with some economically sensitive areas of the market. The mid cap FTSE 250 was up 0.99%, while small caps were down -0.57%. Most UK performance appeared to be underpinned by late quarter interest rate hopes.

In Japan, markets were hot as the Nikkei 225 index saw a 20% gain for the quarter, it was also a historic moment for the Nikkei as it reached an all-time high and moved past 40,000. The broader TOPIX Total Return index also had a stellar run, up 18.1% in Q1. Foreign investors played a large role in fuelling the rally thanks to increased optimism over Japan’s positive economic cycle. As evidenced by the Nikkei, the market’s performance has been driven by large-caps, particularly value companies in sectors such as automotive and financials. The boom in AI and semiconductors has also contributed to the rise in semiconductor-related companies. In contrast, domestic and defensive sectors, including land transportation, services and food have lagged. Corporate earnings have exceeded expectations, with positive revisions in the current year. The weakening yen has clearly provided support, but the inflationary environment is expected to boost earnings for many Japanese companies, especially those with the ability to raise prices.

Asia (ex-Japan) and Emerging markets were weaker compared to other markets in Q1. Taiwan, Peru, India, and the Philippines were the strongest markets, while Hong Kong, Thailand, and China ended the quarter in the red. Taiwan saw strong growth, driven by on-going investor enthusiasm for AI-related stocks and technology companies. Despite some select policy stimulus measures and a mid quarter rally, the Chinese market still ended the quarter down as foreign investors remain cautious on the Chinese economy. Compared to historical averages, Chinese market valuations are now looking cheap, whether this will catch the eyes of investors remains to be seen. China is also weighing on the Hong Kong market, with investors looking elsewhere as Beijing increases its control. India was also a strong performer in Q1, investors there are hopeful for continued political stability if Narendra Modi wins a third electoral victory this year. The past decade has seen continued robust performance from the Indian NIFTY 500.

The Australian market (All Ords Accumulation) was up 5.45% in Q1. Nothing spectacular compared to some other developed markets, but a healthy quarterly return nonetheless, after a brief early January sell off. Listed property was again a strong performer, but IT led the sectors with a 23.62% gain. Consumer discretionary and financials significantly outperformed the broader index, with Commonwealth Bank hitting an all-time high during the quarter. Energy, health care, utilities, consumer staples and communication services all underperformed the index, but stayed in positive territory. The only sector in the red was materials, as it was a case of the iron ore price taking away in Q1 what it gave in Q4. BHP, Rio Tinto, and Fortescue were all in the red for the quarter as the iron ore price spent the quarter on a downward slide. Finally, the ASX small ordinaries finished up 7.55% for the quarter.

This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person or entity. Accordingly, to the extent that this material may constitute general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. This is not an offer or recommendation to buy or sell securities or other financial products, nor a solicitation for deposits or other business, whether directly or indirectly.