Economic Overview

Inflation and interest rates again remained the major points of interest across Q2, but with well over a year of interest rate rises behind us, many economies have proven more resilient than expected. The US economy, in particular, has proven robust despite a total of 5% in rate hikes since March 2022, however it’s suggested the effect of rate hikes has still not been fully felt. Equity markets were positive over Q2. Global equity markets were up strongly again over the quarter, as tech stocks dominated due to a heightened focus on AI, but the resource and bank influenced Australian market posted a more tepid gain. While inflation eased in many economies, bond yields again moved upward throughout the quarter, pushing down bond prices. There remain expectations of further rate rises in some developed markets, but as always, further moves will be dictated by the data.

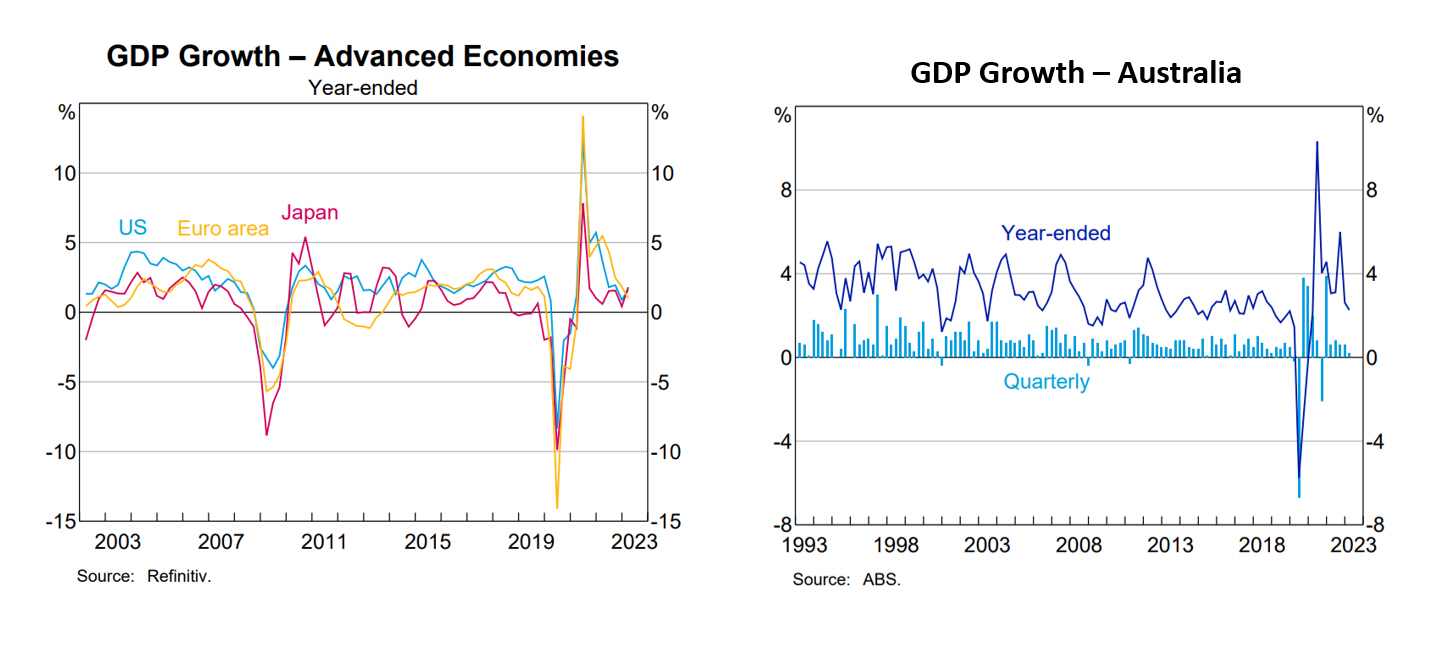

In the US, GDP grew at an annualised rate of 2.0% in Q1 2023, down from the Q4 2022 figure of 2.6%. Real-time GDPNow tracking in Q2 shows the US economy is still growing, albeit now at an estimated 1.8% annualised. Consumer spending, 4.2% and government spending, 5%, both annualised, were strong. However, equipment spending fell sharply, indicating a slowdown in business investment spending, although real construction spending on buildings and manufacturing facilities has doubled so far in 2023 compared to the historic average. This has been driven by infrastructure, semiconductor, and clean energy subsidies, along with tax incentives.

Annual inflation in May came in at 4%, the lowest figure in two years. Declines in energy prices helped to lower the headline number. Inflation has now slowed for 11 consecutive months and is down significantly from the peak of 9.1% last summer. While this is all positive, inflation remains well above the Federal Open Market Committee’s target of 2%. The Federal Reserve raised interest rates by 0.25% in May, but held rates in June, in what’s been termed a “hawkish pause”. There are still expectations for two further rate rises in 2023.

The biggest US concern of the quarter was around the US debt ceiling. However, the concerns amounted to little as the US Congress approved legislation that suspended the debt ceiling in early June, with a deal that included some concessions on spending. Finally, the unemployment rate increased in May to 3.7% from 3.4%. This was larger than expected, but the labour market remains historically tight.

Source: RBA 2023

In the Eurozone, the European Central Bank raised rates twice in the quarter to take the borrowing rate to 4%. Positively, inflation eased during the period, with April’s annual inflation figure of 7% falling to 6.1% in May, with June estimates coming in at 5.5%. Data showed that the eurozone experienced a mild recession over the winter, with GDP declines of -0.1% in both Q4 2022 and Q1 2023, and the future wasn’t looking particularly strong either. Forward-looking data highlighted sluggish momentum across the region. Eurozone flash PMI fell to 50.3 in June, which was a five-month low, suggesting stagnation as a figure below 50 equals contraction. Finally, with the war in Ukraine showing no sign of a resolution, analysts have started warning of energy issues next winter. To recap, energy shortages were largely avoided last winter due to milder than expected weather.

In the UK, the Bank of England raised rates in May and June, with the 0.5% increase in June being a reacceleration after the pace of increases was slowed to 0.25% moves in March. The increase came after a stronger UK jobs figures, wage growth and core inflation readings. April’s inflation reading showed a significant decline from 10.1% to 8.7%, but expectations were for a larger downward move due to last year’s energy price spike coming out of the 12-month figure. With rates at 5% currently, Analysts are now suggesting 6.5% is on the cards by the end of 2023. Inflation aside, the economic picture remained mixed. GDP growth for Q1 came in at 0.1% and is widely forecast to have contracted through Q2. The UK services PMI fell to 53.7 in June, but remained was still a fifth straight month of growth. In contrast, manufacturing figures showed growth declining for the eleventh consecutive month.

In Japan, the Bank of Japan held its first policy meetings under the new governor Kazuo Ueda in April and June. There was no policy change, suggesting a continued dovish position, and with more rate rises likely to come in the US, weakness in the yen accelerated. Inflation came in at 3.2% for May, which is still a marked difference to the historic periods of long-term deflation Japan has seen. While the BoJ maintained a cautious stance, continued wage growth and Q1 GDP coming in at 0.7% suggested the economy was making decent progress.

In China, the roll-back of strict COVID zero policies prompted hopes the domestic economy would roar back to life. However economic data was disappointing and under forecasts. Q1 GDP came in at 4.5% while data released for May across factory surveys, loan growth and home sales, showed signs of weakness. Mirroring the trend across several developed markets, service sector activity continued to grow (albeit under forecasts), while manufacturing struggled, with June being the third straight month of contraction. In response, the People’s Bank of China cut its lending benchmarks for the first time in ten months. With the recovery struggling, pressure is increasing on Chinese policymakers to act in the second half of 2023, with further rate cuts and other economic stimulus.

In Emerging Markets, Greece’s ruling New Democratic party won a second term, suggesting more market friendly policies. Inflation eased in Central Europe with the expectation of rate cuts, with Hungary cutting rates in June. There was optimism in Brazil about potential rate cuts and a better-than-expected Q1 GDP number. Improved macroeconomic data and signs that accommodative monetary policy will be ongoing were also supportive in India, while South Africa’s power situation continued to deteriorate. Saudi Arabia surprised with an oil production cut in an attempt to halt the recent slide in global crude prices.

Back in Australia, data released in June showed GDP increasing by 0.2% for Q1 2023, with the economy growing by 2.3% year on year, this was the weakest reading since Q3 2021. Inflation remained high across the quarter with monthly CPI running at 6.8% for the 12 months ending April 2023, up from 6.3% in March, however, May saw a drop to 5.6%. Falls in transport and fuel prices played a large role in May’s inflation fall. The savings rate fell to 3.7% in Q1 23 and is now at the lowest level since the late 2000’s. After a pause in April, the RBA increased interest rates 0.25% after its May and June meetings, noting that the Q1 inflation figure of 7% was still too high and it expected it would be some time before that number would be back at the board’s target range of 2-3%.

The housing market continued to defy the RBA’s moves on interest rates. Price falls in major markets appeared to have stopped in the first week of February, during Q1, and have marched upward since. Sydney was up 4.9% for the quarter and 6.9% since the market bottomed on February 7, according to CoreLogic. Nationally, dwelling values were up 2.8% across the quarter with every capital registering a gain except Darwin, down -0.3%. Aside from Sydney, Brisbane at 3% and Perth at 2.8% were the strongest capitals. Aside from Darwin, Hobart at 0.1% was the weakest. Regional markets were up 1.1% for the quarter, but overall, the combined capitals were still down -4.8% and the combined regional markets were down -6.5% over the 12 months to June 30.

Market Overview

Asset Class Returns

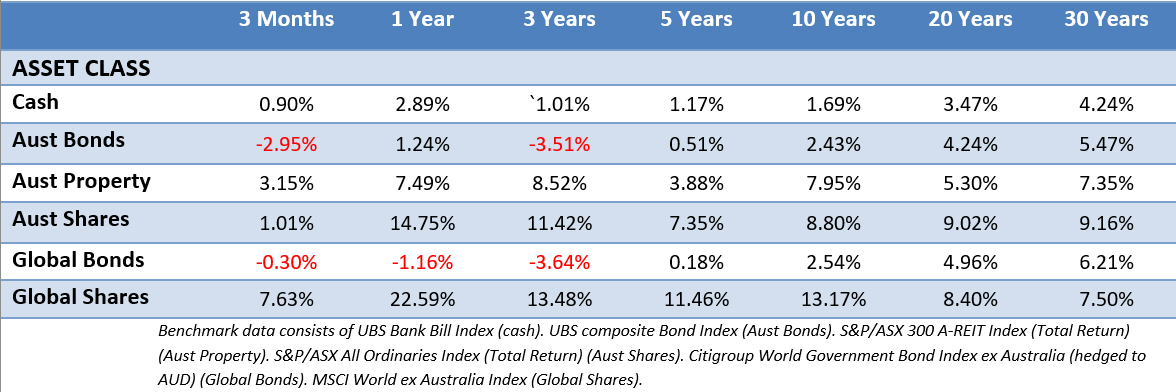

The following outlines the returns across the various asset classes to 30 June 2023.

Global sharemarket returns were again strong in Q2 as markets shrugged off any concerns about the US debt ceiling issue. The Australian market again trailed its global counterparts, but still notched a quarterly gain. Australian listed property had another decent quarter as it attempted to regain ground lost over 2022. Bond prices fell across Q2, as yields again surged with increasing rate expectations. The 10-Year US Treasury yield started Q2 at 3.48%, finishing the quarter on its high of 3.84%. US 2-year yields were also on a steady climb for much of the quarter, ending Q2 at 4.9%. In the UK, the 10-year yield made a swift climb from 3.49% to 4.39%, while the Australian 10-year yield pushed up from 3.30% to finish the quarter at 4.03%.

In the US, the S&P 500 was up nearly 9% for the quarter, making it nearly 17% in the first half of the year. The Russell 2000 small-cap index again trailed its larger counterpart up 5.21% in Q2. Most of the gains came in June after the debt ceiling issue was resolved, inflation appeared to be moderating, and the US economy showed resilience despite higher interest rates. The tech sector led the stock market in the quarter, up 17%. AI and the potential for a boom in related technology drove chipmakers higher. Other top performing sectors for Q2 were consumer discretionary, 16.8% and communication services, 14.6%. Utilities -1.8% and energy -0.5% were the strugglers.

In the Eurozone, after two consecutive quarters as the best performing major region, European equities trailed other developed markets in Q2. In France the CAC 40 was flat, while the German DAX was up 3.3%. The major movers across the region were the financials and the tech sector. As with elsewhere, the tech sector was boosted by semiconductor stocks. This came in the wake of higher-than-expected sales projections from some US chipmakers. Underperformers included energy and communication services. Although late in the quarter, the Dutch government confirmed that high-end chip manufacturing machines will need a licence to be shipped overseas. The Netherlands is home to some leading chip equipment makers, and this may impact exports to China.

UK shares struggled over Q2 with the large cap FTSE 100 down -1.3% and the mid cap FTSE 250 down -2.7%. Energy and basic materials groups were the largest drags due to broad-based weakness across commodities and the poor outlook for the Chinese economy. Domestically focused areas of the market also struggled as the Bank of England raised rates in May and June. While UK markets did well in 2022 due to their weighting to commodities and financials, that weighting, and lack of UK-listed tech companies has proven a headwind in 2023.

In Japan, the Nikkei powered on, up another 18.35% in Q2, hitting its highest level in 33 years in June. This has partly been driven by ongoing buying from foreign investors since April, while there are expectations of corporate governance reforms and shifts in the Japanese macro economy. Weakness in the Yen has further supported a “keep buying” mentality on the Japanese market. While valuations are reaching a fair level, there appears to still be a chance for further upwards earnings revisions in the months ahead.

Asia (ex-Japan) and Emerging markets were mixed across Q2. Across Asia, China, Malaysia, and Thailand were the worst-performers, while share prices in India, South Korea and Taiwan gained. Chinese equities were sharply lower as the brief rebound, after its post COVID restrictions, started to cool. The Hong Kong market also fell in the quarter, as a cooling of the Chinese economy weakened sentiment towards Hong Kong stocks, while the ever-reliable US/China tensions also played a role. In Europe’s emerging economies, Hungary, Poland, and Greece were the top-performing markets, shrugging off recessionary fears in Europe.

The Australian market (All Ords Accumulation) was up 1.01% in Q2 with an up, down, up performance as it gained in April, fell in May, and recovered in June to post an overall gain. As in nearly every other developed market, the tech sector was the winner, with the Information Technology index up 18% and a long way ahead of the next best sector, utilities at 5.46%. As often can be the case in Australia, Q2’s performance was mostly dictated by financials and materials. It was a pull of war with financials finishing the quarter up 3.12% and materials down -2.59%. Consumer staples and consumer discretionary were also in the red, as interest rates increased again.

AI Trading Scams

Earlier in the year, we touched on AI and its potential to be used for nefarious purposes. We tend to keep an eye on internet investment forums because they’re a good place to pick up trends, read what people are thinking about, and note what types of questions people have about their money and investments. As we said earlier in the year about AI:

…fraudsters will soon be telling us they can get amazing returns via AI, their investment fund is AI powered, or their inputs into AI are able to predict the direction of markets and the next market crash. Lies, lies, and more lies.

And if investment forums are anything to go by, scammers pitching AI driven returns started to become more prominent over Q2. Confused people are beginning to ask questions about AI’s potential to predict markets because a fraudster is pushing it at them. While concerned family members are reporting they’ve had to intervene for older relatives who’ve either bought software or signed up to a fraudulent platform promising outrageous returns.

In a way, none of this is anything new. It’s the same old rubbish we’ve seen for years. Only now being pitched with the hook of artificial intelligence predicting the future. And it’s also the same old question investors must ask themselves:

Why would this person need to sell me something for a few thousand dollars, or even go to the trouble of investing my money, if they have a platform (now using AI) that can predict market movements?

The answer is they wouldn’t need to sell anything, or invest anyone else’s money, because every day the market was open their own platform would be raining down profits on them. They wouldn’t need (or want) to share their secret with anyone else.

So, what can you do for yourself, or more importantly, for someone who you believe could be at risk? There’s the obvious talk about ignoring unsolicited phone calls and putting the phone down, however one thing that’s often ignored is the importance of not seeing rubbish in the first place.

The rubbish we don’t want to see are scammy ads. These might be served to someone via their web browser, and it’s only one click to give details to someone who shouldn’t have them. It’s a very simple fix, we can’t click on something we don’t see. And as often as the media warns about scams, in all their warnings the media rarely gives advice to block web ads because they have them on their own websites as a revenue stream. The media also don’t generally vet what appears in these ads because they come via third-party placement.

What to do? There are extensions available for web browsers that block ads. Some are free, some are packaged with antivirus software, or there even browsers like Brave (a browser built on Chrome) which come with built in ad blocking.

Not only does blocking ads make the web browsing experience more pleasant, but it may also cut down the risk of a vulnerable person being caught up in a web of lies before anyone has a chance to intervene. An adblocker may take some tweaking, as they can block too many things and occasionally interfere with the functionality on some webpages. Essentially, it’s a matter of testing and seeing what works, and what limits are needed to balance protection with a good web browsing experience.

Just a suggestion.

This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person or entity. Accordingly, to the extent that this material may constitute general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. This is not an offer or recommendation to buy or sell securities or other financial products, nor a solicitation for deposits or other business, whether directly or indirectly.