What’s the most contentious thing you can think of? Likely it’s something to do with politics. It manages to infect and infiltrate various areas of areas of life, and when people become obsessed with politics, it can begin to play into their decision making.

You could say an extension of politics is a person’s view on how society and the economy is travelling. Or logically, those things combined just equal politics. Some of us may pay these areas no attention at all. Possibly due to sheer good luck or complete non-interest. Never been caught in traffic, never lost a job, never had the car stolen, never agonized over the cost of beef. That’s some good luck and it’s inevitably going to play some part in how you view the world.

Alternatively, if any of those things have happened, a person’s attitude may change. Maybe it doesn’t even require a personal connection, just repeatedly hearing about something in the news may trigger a question about why these things have happened or are happening. We’ll all reach our own conclusions about these things. Maybe those conclusions will be reached with our own introspection or we’ll look to external sources to help us define the root cause.

Maybe discussions with friends and family. Maybe history books. Maybe works of fiction. Maybe a religious text. Maybe the news media.

If you’re going external, it’s inevitable there will be some sort of vested interest looking to influence you toward their way of thinking. When that external source is the news media, there’s no question about it. Though for the most part, a lot of that influencing has been done. With readerships and viewing figures falling off a cliff, media has more than ever started catering to their silos. The smaller groups of intensely loyal people who they know will return, wanting to hear a specific message day in, day out.

However, that doesn’t mean there isn’t other disparate voices out there looking for attention. That’s where some of the media have lost their audience. Go on Youtube and you’ll find professional, semi professional and amateur channels galore. All catering to narrower specifics.

Settle on a specific source, be it mainstream media or alternative, and you may start thinking in line with what those outlets produce. Maybe you already did, but just needed someone to reaffirm your views. It’s comforting to be told you’re right and among a collective with similar thoughts.

That’s fine and there’s nothing wrong with that. Except when it involves tomorrow.

Tomorrow is the unknown and no matter your views about the happenings of today, the one certainty about tomorrow is you don’t know what’s coming next. Over the past decade this lesson has been learned time and again.

Go back before Barrack Obama was elected and his vocal opponents were telling anyone who’d listen he’d unleash a bigger financial Armageddon than the world had seen in the year he was elected. Donald Trump? Same deal. There’s always been someone catering to the dystopic tomorrow of a political entity and how that person will wreck your future unless you heed their warnings. Sometimes, it’s not even politically linked, ‘the end is nigh’ is just someone’s business model.

A few years ago, we had prospective client engage our services. Needed some help getting their superannuation in order. We took a look and it was in a shabby state. Sitting in a high fee bank platform, with a couple of high fee funds, it was poorly diversified with an asset allocation that made no sense. A significant part of the portfolio was in gold.

Was it going to serve their needs in retirement? No, but we soon found the consideration wasn’t retirement.

The person had developed a certain belief about the future. The US economy was heading for imminent disaster and that would cause economic collapse around the world. The person wanted to know what investment solutions we could offer to comfort their belief the financial world would end. We explained that’s not what we do, offered some explanation and we never heard from them again.

We can only speculate how they’d arrived at this belief, but it probably wasn’t by their own hand. This way of thinking isn’t uncommon in some sections of the internet. What does it matter? Well adjusting your money to whatever worldview you’re currently holding comes with a cost.

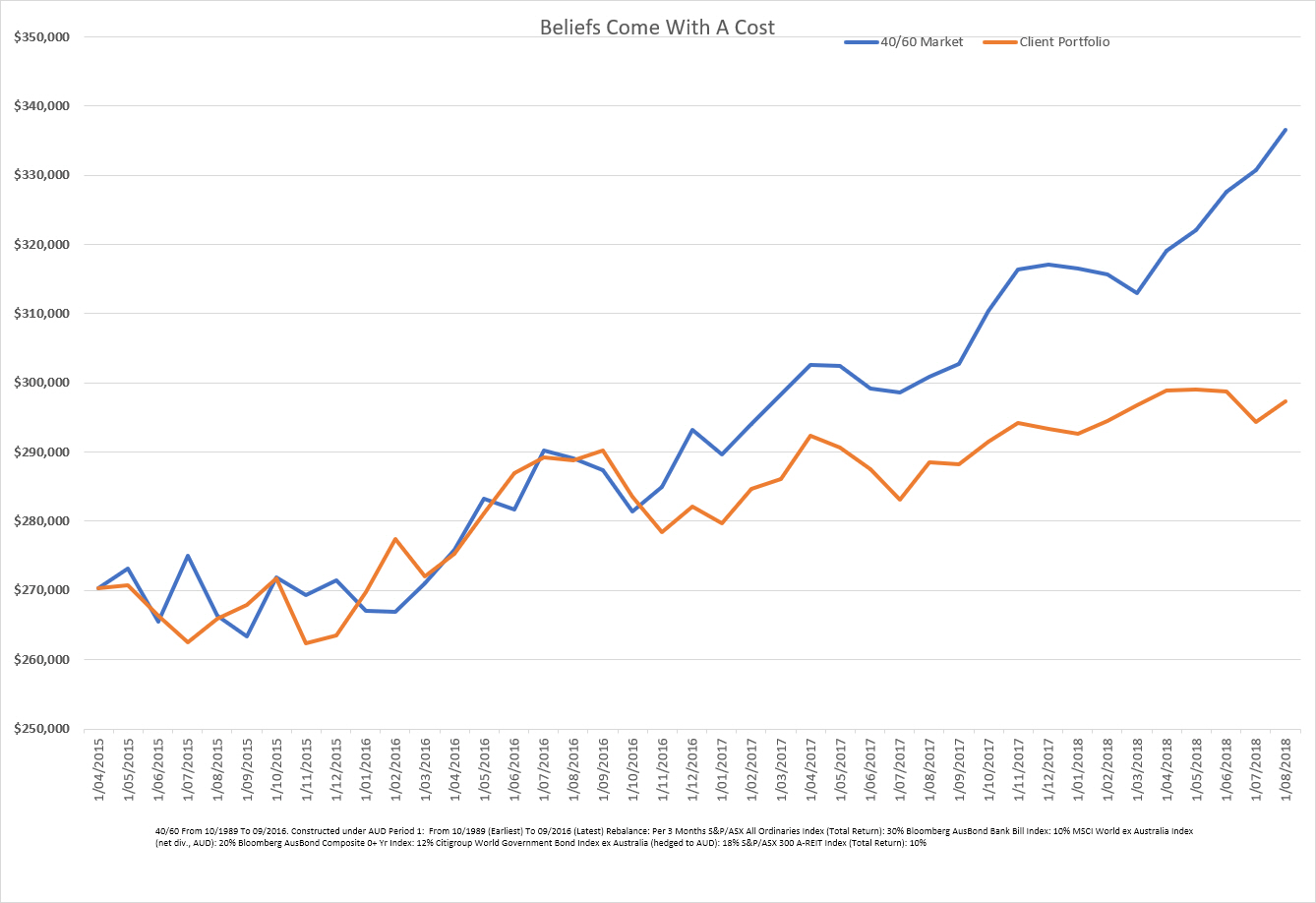

After doing some some calculations on how that person’s portfolio would have performed against a basic 40/60 portfolio over the past few years, we arrived at the cost.

13.18% of underperformance over the past three and a bit years. And this is only based on portfolio value at the time, factoring no contributions, nor the excess fees being charged. Things which would have widened the gap. Of course, anyone sitting around waiting for the disaster will tell you “well it hasn’t happened, just wait until it does.”

Dates come and go, time marches on. There are plenty of investors sitting around waiting for the next disaster, but it’s arguable that more money will be forgone waiting for a crash than will ever be lost in a crash.

A 35% increase in your portfolio will take a 25% fall to wipe out.

A 50% increase in your portfolio will take a 33% fall to wipe out.

Keeping this in context, only once since 1990 has there been a fall on the ASX that exceeded both of those falls in a 12-month period starting December 2007 the ASX took a 40.38% hit. The next largest was 17.51% starting January 1990.

Yet no one sits 100% in equities, or they shouldn’t. That 40/60 portfolio above is up 24.64% since the inception date. It will need a 19.77% fall to get back to where it started. That’s happened only once in 12-month period since 1990, again starting December 2007, down 20.61%.

The next worst 12-month period for that portfolio? Down 8.61% starting February 1994.

None of these outcomes are particularly palatable, but ‘the big ones’ most often talked about are a rarity. Yet some are willing to bet their whole retirement on one off events, forecast by people they don’t know, whose motivations are questionable.

It’s very sad and costly.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs.