We’ve regularly written about the dangers of real estate spruikers because we’ve seen the damage they can do. Fees are built into the sale price meaning the buyer is significantly underwater from day one. The property is usually in a poor area, so capital growth hasn’t occurred. A few years into being a real estate investor a valuation reveals the awful truth that they’ve been dudded.

We’ve had prospective clients sheepishly wander into our office in this situation and we’ve had existing clients also sheepishly admit to being caught. Now this might bring into question the value of financial advice if our clients get themselves into such a mess. However, when asked why they didn’t consult us on this investment they admitted it was because they knew we’d advise against it!

Which underlines the psychology at play here. As reprehensible as the spruikers are, they’re well drilled and skilled at what they do – getting the otherwise inexperienced to act on a major transaction without seeking a second opinion.

This week we got a brief insight into a real estate spruiking seminar. Independent business journalist Michael West was recently cold called by Park Trent to attend a free information night and thought he’d visit the seminar at his local leagues club in Sydney. Michael gave us permission to use the photos he took during a seminar. If you want to know more about Park Trent, ASIC has a nice profile on their activities.

These things always start pleasantly enough – building your wealth and security.

Initially they invoke Australia’s lone strategy for growth – increasing the population. This undoubtedly means your real estate purchase can’t fail to increase in value.

At this point Michael noted the proposition first appeared: “buy from Park Trent, borrow 100%, earn more $$ each week and enjoy the capital gains.”

Soon came the first hint of urgency: buyers had to act quickly because Labor would soon be elected, and negative gearing would be repealed!

No hard sales push would be complete without invoking Warren Buffett, even though Buffett’s returns are stockmarket based.

You won’t be shocked to learn they said the best time to invest was right there and then! Remember, at these things you’re not meant to think and certainly shouldn’t seek a second opinion. You need to act now!

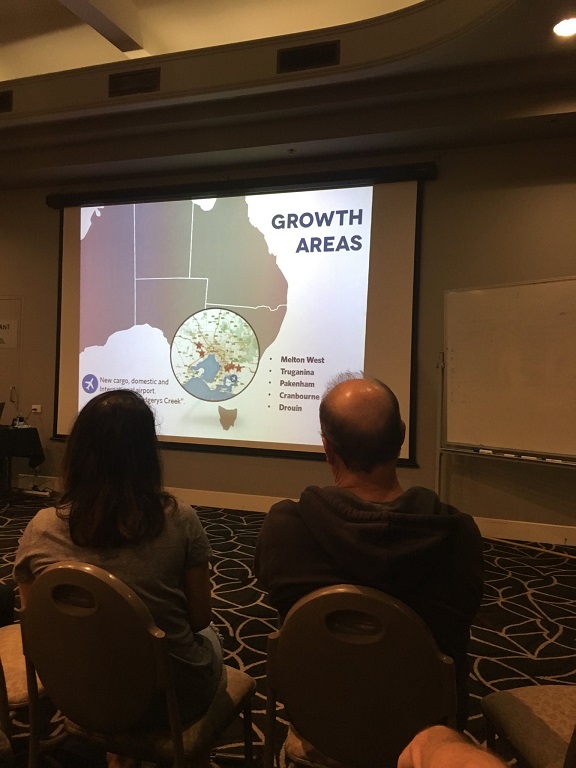

At this point, it’s the places to buy. Of course, these guys know exactly where that is and conveniently they have property to sell there. Their particular favourite was South East of Melbourne, a region they told the crowd “will go up 100% in 3 years” & “you will double your money by 2020-22”.

Finally, the goodies for sale.

Sadly, there were only 2 of these amazing properties left. Hint Hint – grab one before the sucker next to you does!

This is no way to invest. Prompts to buy based on potential legislative changes. Prompts to buy based on forecasts of 100% returns in three years. And the strategy? Borrowing 100% of the purchase price – risk off the charts.

Yes, we’ll always advise against this, but it looked like a good night of entertainment.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs.