Back in the early 2000’s there was a rash of media coverage about safe rooms or panic rooms. It was an armoured room built inside a house where the occupant could ride out a bad situation while waiting for law enforcement to arrive. The rooms became prevalent among wealthy people who lived in urban areas and had fears of burglars busting inside and holding them hostage.

The phenomenon even spawned its own movie in 2002 starring Jodie Foster.

While there are no stats on how many lives the safe rooms saved, fears about personal safety clearly haven’t dissipated. The ultra-wealthy have stepped up from panic rooms and recently been buying boltholes in places like New Zealand in case of societal collapse.

Despite the paranoia, there is something we can all learn from this behaviour – you don’t make your emergency plans during the emergency. The time to plan is well before any event occurs. And when it comes to your investments, the recent restart of market volatility should be a signal that complacency is over. If the emergency plan hasn’t been reviewed, it’s time to do so and ensure you have a safe room ready to protect your portfolio.

What are the things your portfolio safe room should be comprised of?

1. Cash: this the most important thing because knowing you have accounted for what you can spend for 2-3 years means there’s less need to be bothered with short term weekly or monthly market movements. Even if those market movements are down for a quarter or longer your liquid cash will likely ensure you can outlast any market downturn without touching your portfolio.

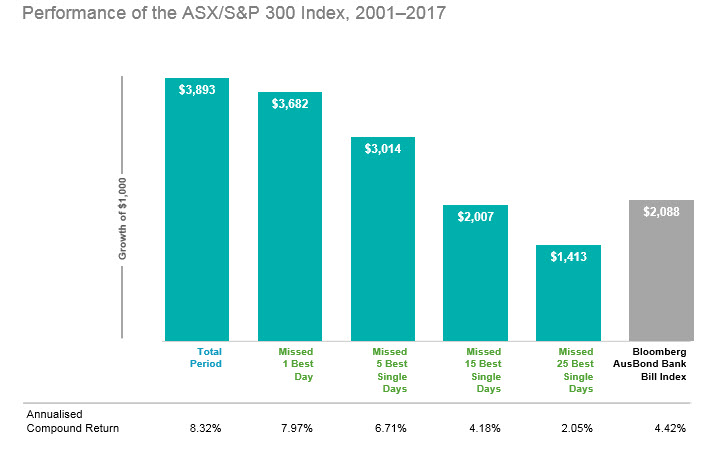

2. Perspective: Corrections of 10% or more are almost a yearly occurrence, but rarely do they turn into full blown crashes or bear markets, however just because you’ve experienced one correction in a year doesn’t necessarily mean that’s it for the year. Financial markets are unpredictable and while the focus is often on downside punishment, rarely do we hear about the upside punishment. Panic and step out, thinking you’ll get back in when it’s safe and it can be costly. Miss the best 15 days between 2001 and 2017 and your return is almost cut in half. Use perspective to maintain your discipline.

3. Understanding: As Clint Eastwood once said, “a man’s got to understand his limitations”. Something to consider when setting up the safe room, well before the door closes. Review your advice documents again, look at your risk profile and see the things your portfolio has done in the past, both positive and negative. If you can tolerate both figures and treat them the same, then you have no concerns. If the downside makes you feel queasy, it may be time for a portfolio rebalance to a more comfortable allocation.

Anxiety is natural and discipline can be hard to maintain, but if you have your portfolio safe room built ahead of time, you can quickly refocus on life, family or work with the knowledge you’ve addressed the things you can control.

Remember, market returns aren’t one of them.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs.