Read any good stock tips on the internet lately? If you listen to our advice, hopefully not!

We’ve long pointed out the dangers of buying individual companies because of a lack of diversification and heightened risk, among other reasons. Now there’s another confirmed danger for anyone getting stock tips from internet sites and online newsletters – the tip writer may be a paid spruiker.

Last month the US Securities and Exchange Commission filed fraud charges against 27 individuals and entities that were engaging in paid stock promotion without disclosing that fact.

Essentially a listed company would hire a stock promoter or communications firm to generate publicity for their stock – with the end intention of increasing the price. Those hired would write overly positive articles about the company and have them published as reasoned analysis on various community based investment sites like Seeking Alpha. However, some managed to find their way onto more recognisable sites like Forbes.

Now to understand the duplicity at play here, one person was found to be operating under nine different pseudonyms. Why? It’s psychological. One person positive on a company is nothing compared to nine people saying a company’s share price is about to hit the roof. The guilty party also gave those nine people backstories to increase their authenticity, claiming one was “an analyst and fund manager with almost 20 years of investment experience.”

A timely reminder that on the internet anyone can be a lawyer, doctor, fund manager or commercial airline pilot – or all those people at once!

How does this relate to Australia?

Australia doesn’t have a shortage of stock promotion websites or email tip sheets. It also has a prominent stock trading forum that is listed on the ASX. All are geared to the spec end of the market.

The stock promotion websites while clearly not transparent, are obvious in their intent – they wouldn’t exist without companies paying for promotion. Why? If a company’s share price is pushed higher they can raise capital at more favourable terms.

The stock trading forum, while great entertainment, is wholly anonymous with administrators unable to deal with the one person acting as nine problem. In the age of VPNs or Virtual Private Networks the same person can sign into 9 different accounts from nine different locations without arousing suspicion of the website administrators. Again, the intent is to whip other less aware users into a frenzy to buy shares they own so the price rises and they sell with a profit – it’s called a pump and dump.

While we’ve long pointed out the folly of stock pickers because they can’t predict the future, at the bottom end of the market they can become self-fulfilling. With smaller market caps the email tip sheets and membership websites have the ability to move shareprices on their own.

This is the 2017 shareprice chart of a small resources company listed on the ASX.

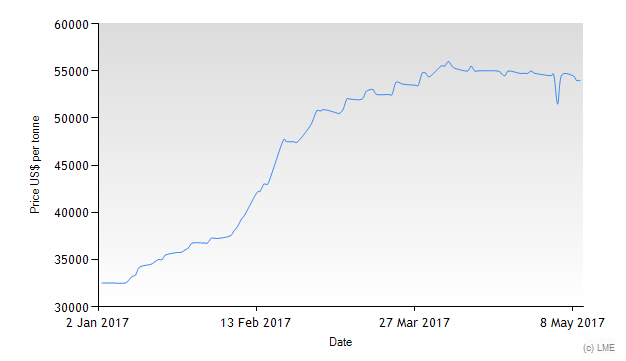

At the start of the year a tip sheet put a buy recommendation on the company. This was after the price of metal the company was looking to mine had steadily increased in price during the second half of 2016. Even better, in the first two months of 2017 the metal price increased over 50% as shown below. The company’s shareprice moved upward with the metal price.

But by the end of February the tip sheet gave the call to sell, saying the metal was overvalued and it was time to take profits. As seen by the two charts, the metal price is slightly ahead of where it was at the end of February, while the company’s share price lost more than 50% of its value and is back below where it was tipped as a buy.

It doesn’t take a cynic to believe those behind the recommendations bought and sold the company’s shares before making the same recommendations to their membership base. And the 23% fall in the share price and highest trading volume of the year following their sell call was clearly triggered by their membership base selling.

Little has changed with the company, but emotion can breed contagion. Other shareholders unaware of why the shareprice was falling likely became spooked and sold out themselves. Driving the shareprice even lower.

What’s the takeaway here? Individual shares are always risky. While promoted shares and recommendations on shares are doubly risky. You never know who is behind them and what their intentions are.

It’s why a portfolio should be invested across multiple funds, asset classes and jurisdictions. No one can pump and dump a diversified portfolio.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs.